What is Coincheck

Coincheck is a cryptocurrency exchange focused mainly on the Japanese market. Work is also carried out for clients outside the country, but to a limited extent. There are a number of reasons that should motivate novice traders to pay attention to this crypto exchange:

- Simplicity and functionality . Coincheck is implemented with Japanese straightforwardness and simplicity. The service provides all the functions at once without dividing into levels and other complexities. For those who consider themselves advanced in matters of trading and using complex tools, Coincheck offers several options:

- NFT trading platform;

- OTC trading for large transactions;

- Trading system for professional traders with additional features.

- Top level security . The traditional for the crypto industry scheme of storing cryptocurrencies on cold wallets is supplemented by a full verification of each client up to confirmation of the address of residence, which excludes the possibility of working with the service of people impersonating others for the purpose of fraud or penetration attempts;

- There is no trading commission . Coincheck does not charge any commissions on transactions from either the taker or the maker, regardless of the volume of trade at the end of the reporting period.

The only point that causes disappointment is the small number of coins offered for trading. Coincheck is not suitable for fans of a wide range of offers and new, very cheap coins for multiple growth. Each cryptocurrency listed on an exchange has a history, value, volatility, and good liquidity.

What services does Coincheck offer?

For the convenience of understanding the essence of the Coincheck service, we have collected key features and services with brief explanations of their essence and benefits for users.

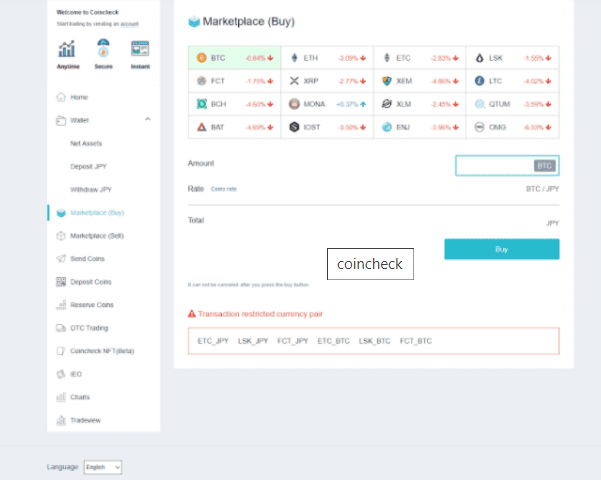

Quick purchase/sale/exchange of cryptocurrencies

After passing the verification, the client gets full access to all functionality. Buying/selling assets is the essence of any exchange, and on Coincheck it is reduced to clear and understandable functions. There are buy and sell blocks in the exchange control panel. The information is presented in an unusual form – a window, without charts and the current state of the market.

The transaction consists only of the fact of exchanging the existing crypto or fiat currency for the one that is needed at the moment.

Easy to use platform

Simplicity is the key to success. Coincheck is considered this way, since the main focus is on novice users who will grow with the exchange. All functions of the exchange are displayed in separate windows so as not to get confused and not fill the focus with information that is not needed at the moment. The left side of the window contains all the necessary transitions and links, as well as settings to customize the interface to fit your needs.

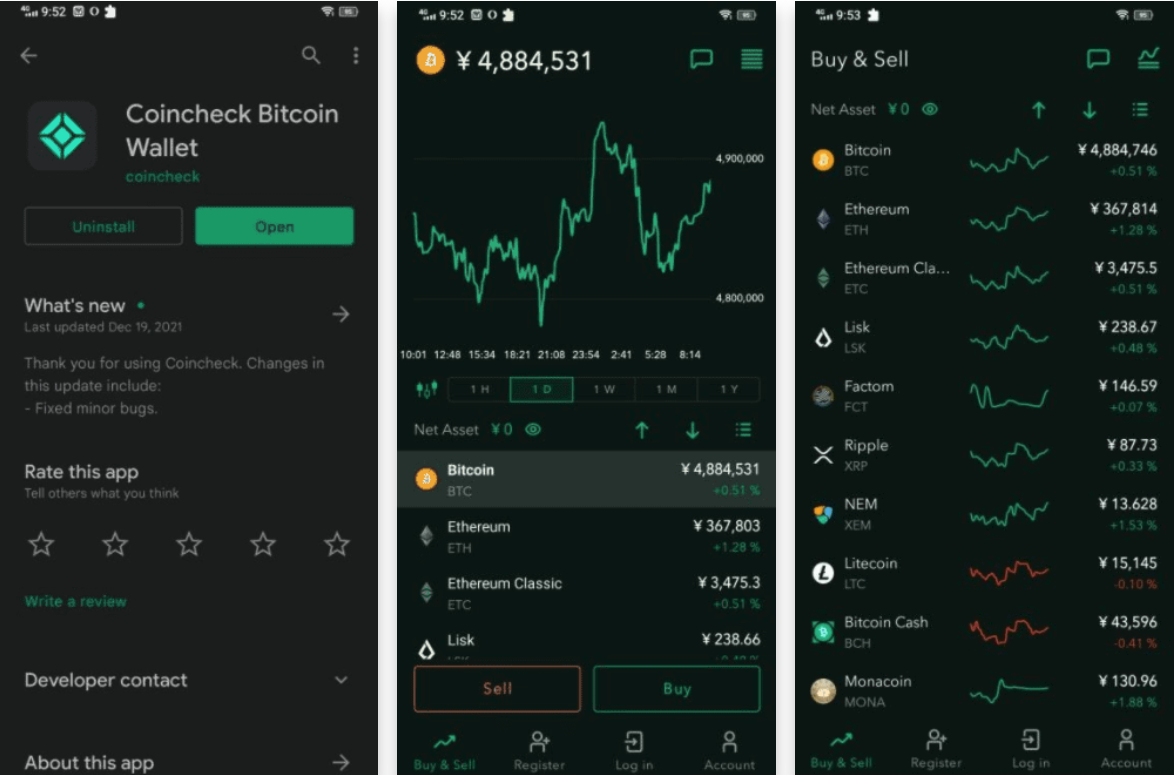

Mobile applications

Without smartphones, modern life seems impossible, and even more so for advanced Japan. All the functionality, which previously required a mountain of electronics and literature, today fits in a very small smartphone case.

The mobile app from Coincheck is even more simple and airy than the desktop version. To fully use the application, you will first need to register in the desktop version and go through the verification procedure, so that when authorizing in the Coincheck mobile application, the system authorizes the user and allows you to use all the functionality. Through the mobile application, not only trading functions are available, but also depositing and withdrawing funds without additional restrictions.

Advanced trading system

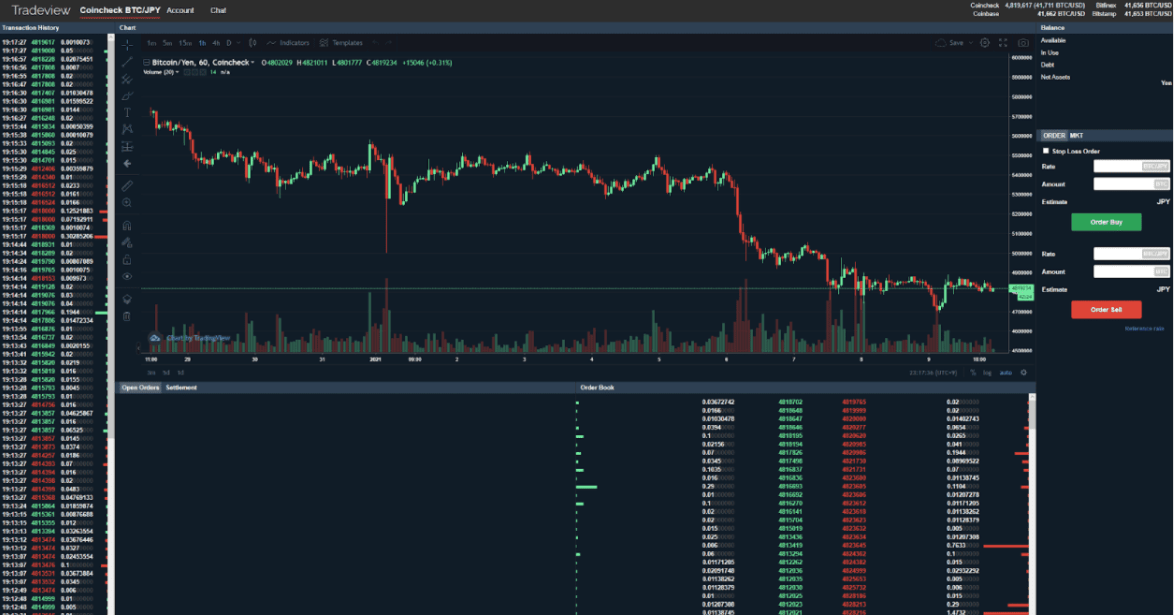

Aimed at beginners and those who use the crypto industry for additional income or small, private investments, Coincheck does not forget about traders with experience and who require special attention. For this, a number of functions have been developed that are highly appreciated by traders with large deposits:

- Placement of orders to optimize profits and trading strategy;

- TraideView for building trading systems and adjusting the price chart to suit your needs for greater profitability;

- An over-the-counter table for conducting transactions with large volumes of assets so as not to influence the exchange rate on this site too much.

Best Altcoins Available

As already mentioned, Coincheck is not the leader in terms of the number of cryptocurrencies in the listings. Only 17 cryptocurrencies are represented on the platform, including BTC and the most traded altcoins – ETH, XRP, LTC, BCH. Since the market for these coins is huge, they are a great tool for investing and leisurely trading, which is preferred by beginners. Users with experience and a willingness to take risks may not find enough tools as on other sites, but high liquidity and large trading volumes alleviate this shortcoming.

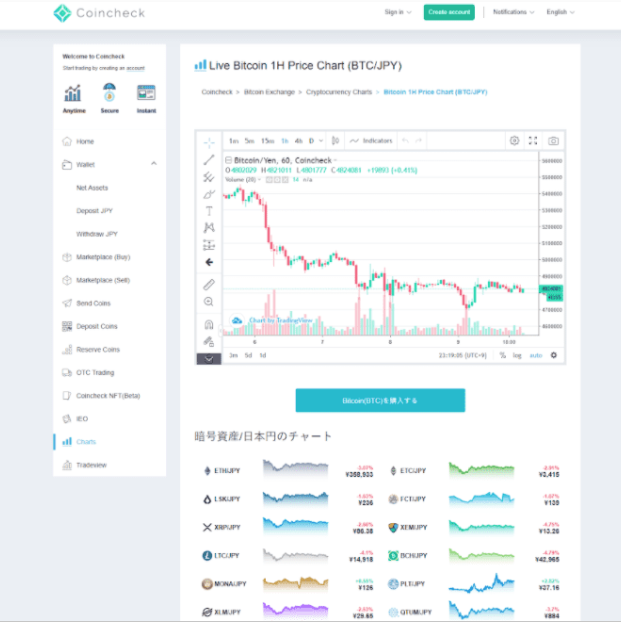

Individual charts available

In a special section for generating charts, a trader can create a convenient tool for analyzing the current market situation. The only thing to keep in mind is that there is no peg to the US dollar on Coincheck, only to the Japanese yen. So charts need to be generated between cryptocurrencies, or third-party tools should be used.

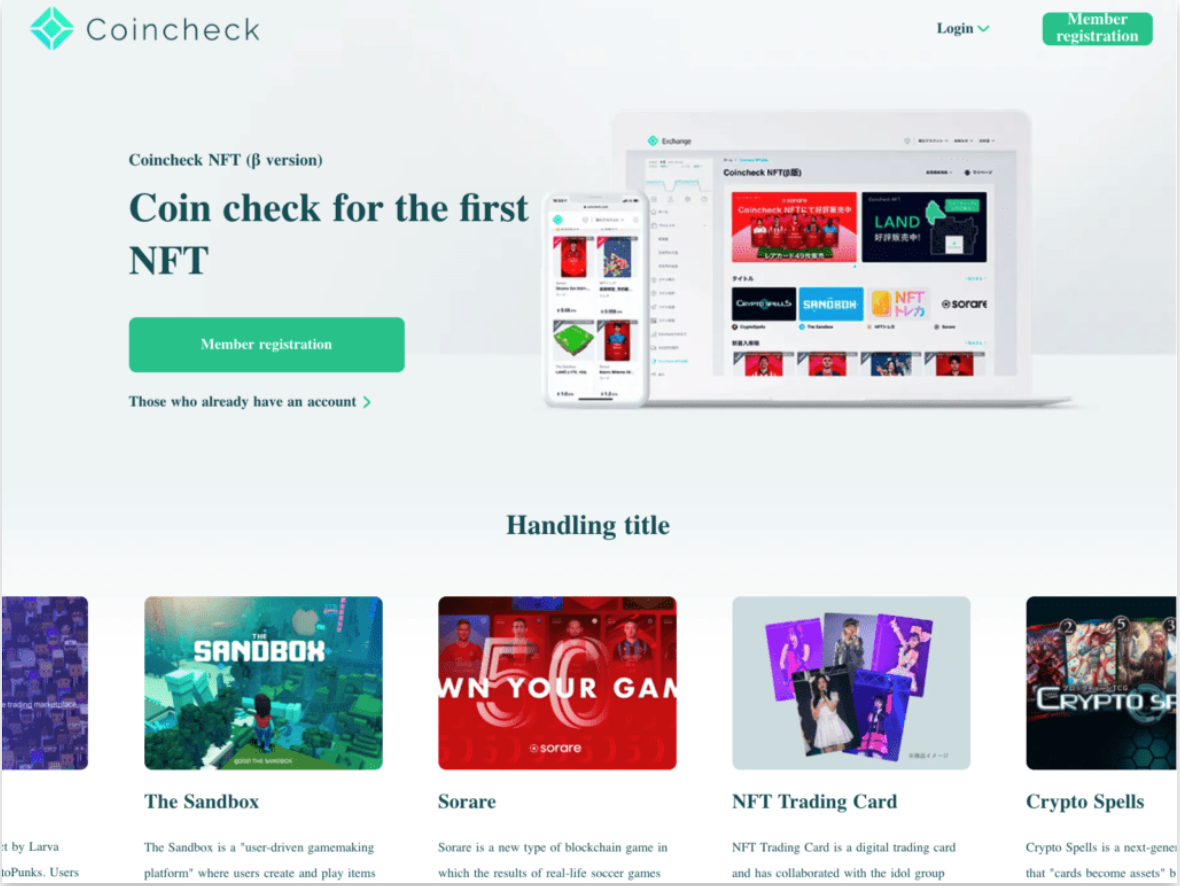

Available NFT Market

NFTs have become a new topic of discussion and their market is experiencing tremendous growth and popularity today. In fact, every NFT is a work of digital art created by people, brands, companies, and so on. Like cryptocurrencies, NFTs can be bought and sold, as well as stored on special services in anticipation of a price increase, just like classic art. Crypto exchanges are increasingly willing to include NFT in their functionality, but Coincheck was one of the first to navigate the new direction and created this section for its clients. For Japan, where anime was born and develops, NFT has become just a new stage of development.

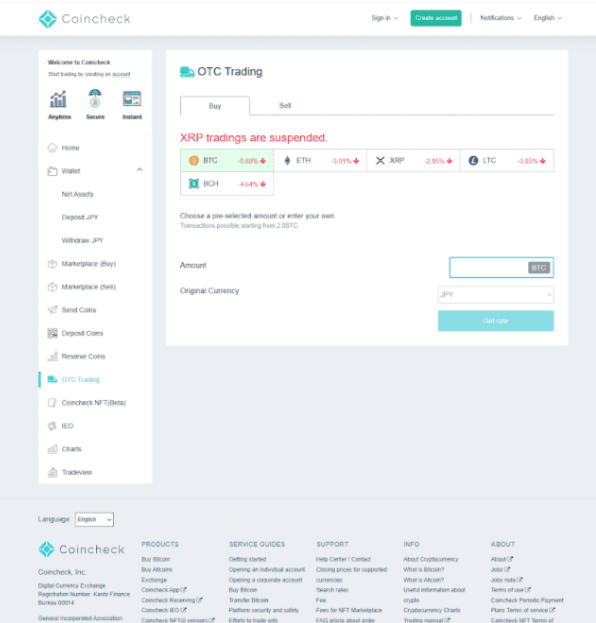

OTC trading included

Large traders working on Coincheck get the opportunity to conduct transactions in the over-the-counter market. Buying or selling large batches of assets at a time leads to price slippage, a drop in liquidity, and can even create prerequisites for panic among ordinary traders. To avoid this, over-the-counter transactions have been created, when personal managers select the optimal algorithm for placing orders on the world market in order to obtain the desired asset at the most favorable price.

Lending on Coincheck

Lending against a deposit or current assets on cryptocurrency exchanges has become commonplace. Coincheck encourages customers to lend their coins as a loan or borrow them from other customers. Coincheck acts as a guarantor in this transaction. The interest rate on a loan for a lender is on average 5%, but depends on the coin in which the loan is made. After the conclusion of the transaction, the coins are blocked by Coincheck on the accounts and it will not be possible to use them until the end of the loan contract. If you think that the market is preparing for a strong move and are ready to pay the interest on the loan, this feature will help increase the profitability of trading.

Ease of depositing and withdrawing funds

In addition to cryptocurrency transactions, Coincheck also supports bank cards, as well as transfers. This allows beginners to realize their potential from any source. Card and bank transfers may take time to be credited, this is standard practice.

Excellent security features

The traditional practice of storing cryptoassets offline in cold storage keeps client funds safe from theft, even if the platform’s security systems are compromised. In addition, each client confirms his identity and address. Which minimizes the performance of fraudsters under the guise of clients, and without this, work on the stock exchange becomes impossible. Actually, the greatest insurance against force majeure is the withdrawal of assets to third-party storage, which makes the process of hacking the trading platform useless, there is simply nothing to steal from there. But this does not diminish the need to apply the security settings of a personal account and an application in a smartphone in order to avoid their hacking and withdrawal of funds under the guise of ordinary trading activities. There is also that what many clients do not like, which is why they sometimes refuse to work with the Japanese crypto platform Coincheck. Japanese yen is the only fiat currency This is one of the main cons of Coincheck, which can keep many traders and investors away from the platform. Coincheck only supports deposits in JPY when it comes to fiat currencies. This means that all actions on the platform are performed in JPY and not in any other fiat currency. Users can only deposit and withdraw JPY using the available methods. You may be able to use your credit or debit cards, but the currency will be converted to JPY. For card transactions, this will mean double conversion and significantly increase the cost of replenishment. Japanese yen is the only fiat currency This is one of the main cons of Coincheck, which can keep many traders and investors away from the platform. Coincheck only supports deposits in JPY when it comes to fiat currencies. This means that all actions on the platform are performed in JPY and not in any other fiat currency. Users can only deposit and withdraw JPY using the available methods. You may be able to use your credit or debit cards, but the currency will be converted to JPY. For card transactions, this will mean double conversion and significantly increase the cost of replenishment. Japanese yen is the only fiat currency This is one of the main cons of Coincheck, which can keep many traders and investors away from the platform. Coincheck only supports deposits in JPY when it comes to fiat currencies. This means that all actions on the platform are performed in JPY and not in any other fiat currency. Users can only deposit and withdraw JPY using the available methods. You may be able to use your credit or debit cards, but the currency will be converted to JPY. For card transactions, this will mean double conversion and significantly increase the cost of replenishment. that all actions on the platform are performed in relation to JPY, and not in any other fiat currency. Users can only deposit and withdraw JPY using the available methods. You may be able to use your credit or debit cards, but the currency will be converted to JPY. For card transactions, this will mean double conversion and significantly increase the cost of replenishment. that all actions on the platform are performed in relation to JPY, and not in any other fiat currency. Users can only deposit and withdraw JPY using the available methods. You may be able to use your credit or debit cards, but the currency will be converted to JPY. For card transactions, this will mean double conversion and significantly increase the cost of replenishment.

A small number of listed cryptocurrencies

For those who are accustomed to the vast supply of coins and the constant listings of new tokens, Coincheck will not work. Only 17 cryptocurrencies are traded on it and the process of adding new assets takes a long time to study the trading history and potential. On the other hand, the best coins are always volatile, and their liquidity allows you to operate large volumes of coins without delays and price drawdowns.

Lengthy verification process

Verification of the client’s identity on Coincheck is complex and any activity on the platform begins with it. Even replenishing an account from a bank card is impossible without passing a full verification with the provision of a full package of documents, including the place of residence. This creates some problems for those who, in search of a favorable rate or liquidity, are trying to register quickly. But for other clients, the exchange itself and potential users in the future, this approach is beneficial and justified, since profitable trading can only be when you are confident in the safety of funds.

No chat support

This factor plays an important role, especially for novice traders who can make mistakes and want to resolve them as quickly as possible. There is no chat on Coincheck, and no phone numbers for live support. The only way to communicate is by e-mail, which is quite long and not always effective.

Coincheck fees

They are present, as in any cryptocurrency exchange. The amount of fees depends on the type of currency in which the transaction takes place and the method of depositing / withdrawing assets. Recall that Coincheck only accepts Japanese yen as a fiat, which is not convertible from every currency and not every bank, therefore, before replenishing, please clarify this question depending on your situation.

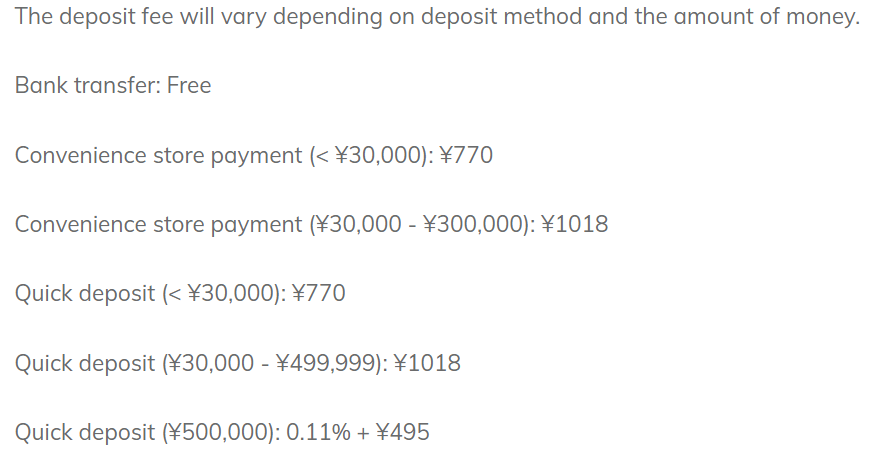

Deposit fee

For a simpler understanding of the fee policy, we have summarized them in an illustrative example.

Surprisingly, Coincheck does not charge transaction fees to either takers or makers. For crypto exchanges, this is a unique case, because it is transaction fees that are the main source of profit for the company itself. This attracts a large number of novice traders to the exchange, for whom every share of the commission is important, since there is still no experience and patience to withstand long-term transactions. Surprisingly, Coincheck charges 0% from takers and makers. Platforms certainly very rarely charge very low fees, but we are talking about absolutely nothing here. In other words, users can enjoy trading with Coincheck without worrying about any fees for each open position.

Fiat withdrawal fee from Coincheck

Withdrawal of fiat money from the crypto exchange is available only in Japanese yen. If your currency is different, you need to take care of opening a JPY account to receive transfers from the company. The commission fee is a fixed amount of 407 yen for each transaction, regardless of the transfer amount. This suggests the idea of withdrawing larger amounts, reducing costs, but not everyone can accumulate sufficient assets and not put them back into business. Due to the fact that fees for completing a transaction may also be included in the commission fees, it is impossible to place all the information in the table. Up-to-date information on coincheck.com. Separately, it should be noted that transfers of cryptocurrencies between accounts of the Coincheck crypto exchange occur without commissions.

Pros and cons of Coincheck

Everyone for himself forms an understanding of what is a positive or negative side in terms of convenience and reliability. We have compiled the reviews of thousands of the company’s customers into lists, we hope these factors will help in making a decision. Pros of Coincheck:

- Instant buying and selling of high volumes of crypto assets. Very high volumes are traded through an over-the-counter desk with a personal manager;

- The trading platform has advanced features for experienced traders;

- NFT platform for full transactions with new assets;

- Crypto lending to generate interest income;

- High liquidity of assets;

- There is no trading commission;

- Fully functional mobile application.

Cons of Coincheck:

- A total of 17 supported cryptocurrencies;

- JPY is the only fiat that the platform works with;

- No live chat or phone support;

Conclusion

The main task set by the founders of the Coincheck crypto exchange, namely the creation of a cryptocurrency trading platform focused on the Japanese market, has been completed. For the inhabitants of this country, Coincheck has become the main operating platform. Of course, this applies to those who work within the framework of available cryptocurrencies, are engaged in long-term investment or work with the Japanese yen. At the same time, many foreign traders come to Coincheck because of the reliability, high liquidity of assets, additional services for experienced traders and the absence of a trading commission.